Golden Sparrow - Q2, 2025 Newsletter

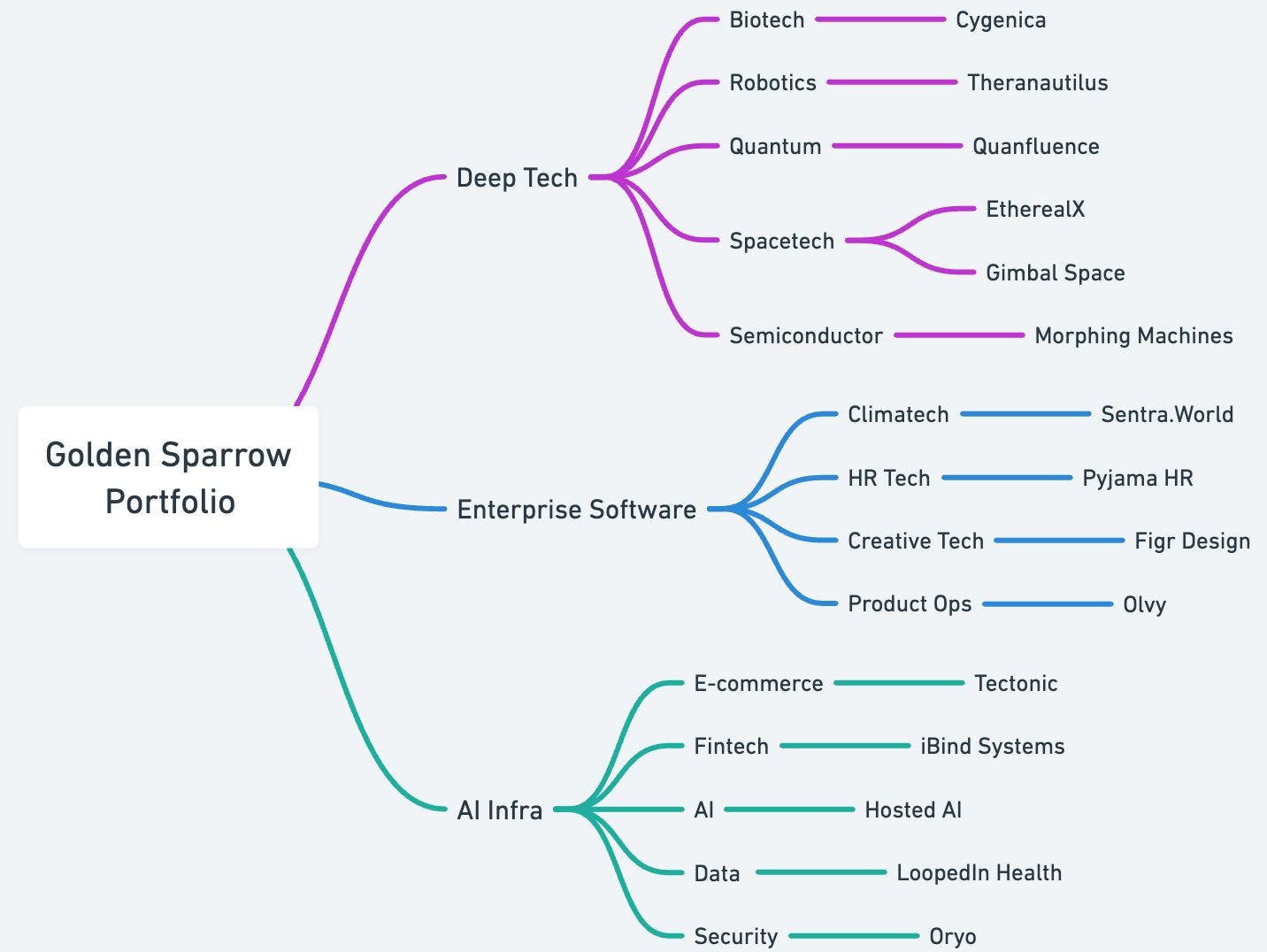

Golden Sparrow is an $8 million India-focused, early-stage fund. We invest in Rare Birds across AI, Infra and Deep Tech.

“If you want to be a great VC, you need to be uncomfortable most of the time” Unknown

Two years ago, we launched Golden Sparrow.

Since then, we have spoken with over 1,200 founders. Each conversation balanced a “prepared mind” with the freedom to dream alongside the founder. It remains one of the most fulfilling aspects of investing and that tension defines our approach: agility, curiosity, and the ability to spot outsized outcomes at the edges of Deep Tech and AI.

Our $8M Fund is now 75% deployed across 15 investments. Cygenica, Morphing Machines, Tectonic, and EtherealX have received term sheets for new funding rounds during this quarter, expected to close shortly. Our pro-forma TVPI places us in the top 10–12% of funds of our size and vintage – though capital returned remains our ultimate measure.

Last week in Bangalore, a General Partner at a larger Venture Capital firm said that his business—much like startups—is about “survival.” I do not share that view. Survival is a byproduct of performance. At the 50th percentile, venture returns are uninspiring. The story changes meaningfully from the top quartile onward.

Golden Sparrow must be in the top quartile—or return at least 5x the fund. Otherwise, it is not worth doing.

This quarter, we added two investments: one in Deeptech, another in AI infrastructure, reinforcing our core thesis. With enterprise AI adoption accelerating in the US, several of our portfolio companies are expanding there. Oryo, our latest co-investment with Village Global, exemplifies Indian global talent positioning closer to customers by building trust-layer agentic AI from the US.

Given strong early interest, we will begin raising Fund II in Q4 2025, targeting $20 million, prioritizing our existing 62 investors. Agility and disciplined fund sizing remain central to our approach.

By The Numbers

LPs in the fund: 62

Investments as end of this quarter: 15 (up from 13 in Q3)

Number of Deep Tech investments: 6

Number of AI Infra and Applications investments: 9

% of fund deployed: 75% (up from 65% in Q3)

1:1 founder discussions held this quarter: 115

Due Diligences conducted this quarter: 7 (6% selection rate)

Fund controlled by female LPs: 28%

Expert Venture Partners: 5

Full-time talent at the fund: 3

Inside Oryo

“In future there will be billions of AI agents running 24/7 making us more productive, efficient, and closer to each other.” – Vinod Khosla

Agentic AI can ingest data, make decisions, and take action. Tasks once handled by employees are now being executed by autonomous software. As adoption rises, the challenge shifts from capability to control. Today, Chief Information Security Officers manage identity and access. Okta, a $30 billion company, anchors this trust layer for humans. But enterprises will soon need similar infrastructure for non-human agents.

Prashant and Swaroop, veterans of Okta and Wix, are building this trust layer from the US via their MCP protocol, specifically designed for enterprise autonomous agents.

Oryo joins our other AI infra startups — HostedAI and LoopedInHealth — all founded by Indian-origin teams in the US, closer to enterprise demand. Our US-based Venture Partners — Michael, JB, and Anand — actively support these global Indian founders and help extend our diaspora access.

We wrote the first check into Oryo, securing our place on the cap table before Village Global and Seven Hills subsequently joined the round.

Inside Gimbal

Just after sunset, clear skies reveal satellites in Low Earth Orbit (LEO). Currently numbering 12,000, LEO satellites could surpass 80,000 by 2030—a $100 billion market facing high launch costs and limited component supply.

SpaceX reduced launch costs from $10,000 to $2,000 per kilogram, while our portfolio company EtherealX targets $500. Still, satellite hardware remains costly and slow to procure.

Gimbal Space addresses these challenges by developing modular, readily available and cost-effective satellite components without traditional expensive radiation-hardening, leveraging Indian manufacturing efficiencies. Founder Dhaval, who previously built at Planet Labs and Tesla, secured US and Indian revenues within one year—a rare feat in Deep Tech.

Our $300K investment positions Gimbal as a potential multi-fund returner.

India’s Deep Tech Status

By next year, every iPhone sold in the US will be assembled in India, though key components will still rely on China and Taiwan.

Annual Deep Tech investment in India remains modest at $1B, but a shift is happening: from just 1% of Indian venture capital in 2017 to 15% by 2025. Government programs and school labs have played the “R” in R&D. As early movers, we increased our Deep Tech allocation to 40%, spanning semiconductors, spacetech, nanorobotics, biotech, and quantum computing.

Meanwhile, the US is retreating. Federal funding for deep science has dropped to its lowest levels in decades, shifting the center of innovation and talent toward India, China, Australia, Canada and Europe.

Few funds lead with a Deep Tech-first approach. Pi Ventures and Speciale—among the most consistent—are deploying from $60M–$80M funds. Half of our Deep Tech deals are co-invested with them. New follow-on funds from Yali and Celesta, both about $100M, reinforce our belief: if you build, funding will follow. We believe our size and approach are well suited to this moment.

Inside the India Trade

When I left the family business, I placed a 25-year bet on India – anchored in long-term conviction and accepting of the geopolitical risk. Recent exchanges of fire between India and Pakistan beyond Kashmir are a reminder that country risk is not zero. While India can project power without full-scale war, future escalation remains a risk.

Yet India’s tech market increasingly resembles Silicon Valley in the late ’90s. IPOs worth $20B are expected in 2025, including Zepto, BoAt, PhysicsWallah, and InCred. Foreign capital is returning: BlackRock, Sanlam, and others are setting up shop.

The BSE is up 5% this year, though volatility lingers amid geopolitical tension. The Reserve Bank surprised markets with a 50bps rate cut to 5.5% and reduced reserve requirements. GDP grew 7.4% last quarter, led by construction, manufacturing, and tax collections. Inflation is projected at 3.7%, the lowest in six years. Despite the uncertainty, India remains the fastest-growing major economy, poised to surpass Japan’s GDP imminently.

We remain convinced that outsized outcomes come from the edges. We are early in Deep Tech’s journey, but early is where the edge lies.

Thank you for being with us on this journey.

See you here next quarter.

Rishaad